Medical Cash Indemnity Insurance

With deductibles, co-pays, coinsurance and total annual out-of-pocket amounts on health insurance plans in the thousands of dollars and getting higher and higher it makes total sense to add supplemental Medical Cash indemnity Insurance to your personal portfolio of medical insurance financial protection. There are a variety of coverage options on these plans such as coverage for Accident treatment expense, daily hospital cash benefit for each day hospitalized from sickness or accident, critical illness lump sum cash benefit for specified critical illness and more.

This type of coverage pays directly to you and some polices pay without regard to any other insurance coverage that you may also have in place and do not coordinate benefits with other insurance. The money received from one of these plans may be used any way you see fit to help pay everyday living expenses while you are being treated recuperating. These plans have various options of coverage benefits and We offer this type of insurance coverage through several different insurance carriers. Please complete the contact form and specify that you would like a quote for Supplemental Medical Cash Indemnity insurance.

Critical Illness Insurance

Bills are the last thing you want to worry about when you are seriously ill. A Critical Illness policy can be a financial life saver for a catastrophic health event such as cancer, heart attack, stroke, renal failure, organ transplants and other conditions that may be covered by the particular Critical Illness plan you purchase. These plans pay either lump sum cash benefits or treatment specific cash benefits for you to use any way you see fit such as paying your mortgage payment, car payment, groceries and other everyday living expenses while you are being treated and recovering from a covered event of your Critical Illness policy. Over 60% of bankruptcies in the U.S. are due to people not having adequate insurance coverage. A Critical Illness policy can make a huge difference and relieve financial stress of a Critical Illness. Let us help you decide which Critical Illness coverage plan may fit your needs and budget.

Disability Income Insurance

Your most valuable asset is your ability to earn a living. How would you continue to support yourself or your family if you were disabled for any length of time because of an illness or injury? The risk is very real. 3 in 10 workers entering the workforce today will become disabled before retiring. Your chance of missing at least 90 days of work due to disability is 1 in 3. We can provide you a premium quote and information on;

- *Long-Term Accident/Sickness coverage

- *Short-Term Accident/Sickness coverage

- *Short-Term Accident Only coverage

- *Business Operating Expense coverage

Please complete the contact form and indicate you are interested in Disability Income Coverage. We will contact you for additional information in order to provide you a premium quote.

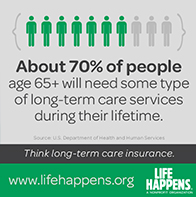

Long Term Care Insurance

With nursing home and around the clock home health care costs averaging around $80,000 per year and expected to climb higher it only makes sense to have Long Term Care Insurance. The 'sweet spot' in premium pricing to purchase long term care Insurance is when someone is in their forties. The younger and better health a person is the better premium rates the person is going to get. We can go over plan options with you and put together a plan that will work for you to protect your estate from being eaten up by long term care expenses.

With nursing home and around the clock home health care costs averaging around $80,000 per year and expected to climb higher it only makes sense to have Long Term Care Insurance. The 'sweet spot' in premium pricing to purchase long term care Insurance is when someone is in their forties. The younger and better health a person is the better premium rates the person is going to get. We can go over plan options with you and put together a plan that will work for you to protect your estate from being eaten up by long term care expenses.